Asbestos Liability Forecasting

Corporations and asbestos trusts have a pressing need to predict incoming claims, approvals, present and future liabilities, and the calculation of a payment percentage in order to fulfill their capacity and meet their business’ commitment. With Verus’ analytical forecasting services, the clients receive insightful, data-driven reports that provide trusts and companies with powerful information to enable them to minimize risk, make better decisions, and improve the management of their reserves. Clients are able to act on facts instead of hypothetical scenarios.

Verus’ approach is based on the combination of strong forecasting services and deep understanding of the asbestos arena. In order to provide robust information, our process begins by conducting a comprehensive assessment of the fund’s status by identifying the following components:

a. Trust/Company Assets

b. Liabilities:

- Current Liabilities – Active Claims “Known” to the Trust

- Future Liabilities – Forecast of Future Claims (not yet filed) and Values

- Supplemental Payments – if an increase to the payment percentage is being considered

c. Income – Investments and Other Sources

d. Expenses – Administrative Expenses, Taxes, etc.

Once the initial assessment is concluded, the team will compose a flexible analytical model report with visual displays that will include the following items:

- Forecast of incoming claims filings

- Forecast of approvals rates

- Forecast of offer values

- Estimate of present and future liabilities

- Calculation of a “base” payment percentage

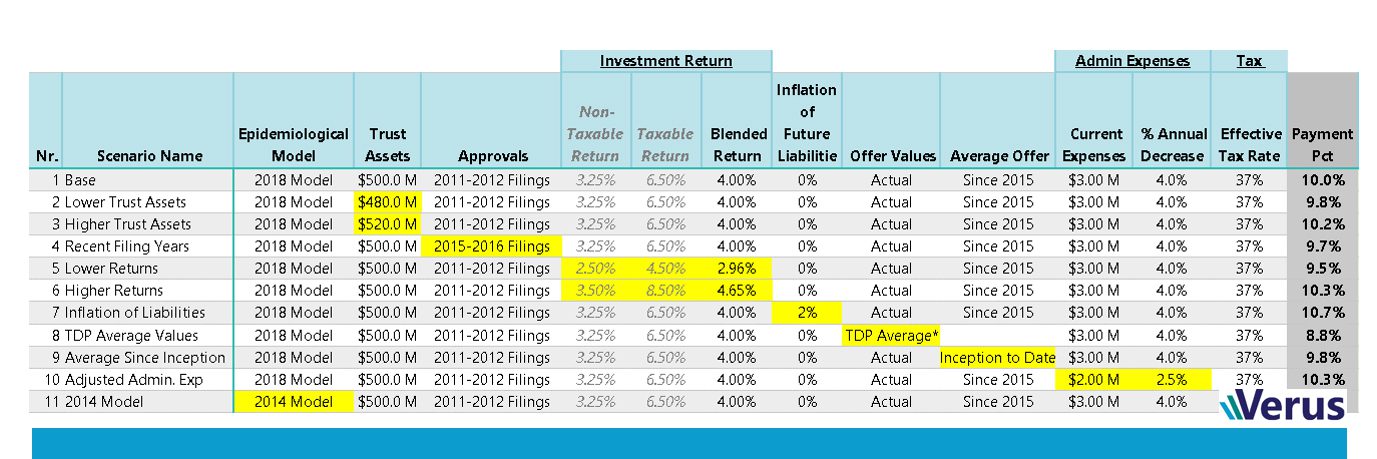

- Additional “What-If” scenarios examining how changes to the “base” assumptions may affect the payment percentage. The scenarios may include adjustments to:

- Financial assumptions (ex. increase or decrease in investment returns)

- Adjustments to filing rates, approval rates, or offer values

Sample graph of the different “what-If” scenarios:

…If investment returns are lower (or higher)?

…If approval rates go up?

…If increased filing of other cancer claims?

- Three monitoring services (monthly, quarterly, bi-annual, annual):

- Basic Trends Monitoring: Analyze the basic trends affecting the trust (i.e. filings, approvals, offer values)

- IR Model Monitoring: Analyze the status of the IR Model and any underlying factors that are impacting the valuations of the IR Model

- Payment Percentage Monitoring: In addition to analyzing underlying trends, we can calculate an estimated payment percentage based on current trends.

- Payment Percentage Review: Actuarial reporting that takes a deep dive into the payment percentage. This is designed to meet the needs of a periodic estimate or adjustment of the payment percentage.

- Custom Analytics Services: Customized analyses tailored to the needs of the trust.